Introduction

The incredible rise of Bitcoin has spawned a parallel evolution of hundreds of alternative cryptocurrencies collectively referred to as altcoins aiming to build on Bitcoin’s innovation or offer differentiated value. As the crypto universe expands exponentially, this guide explores the origins of altcoins, how they contrast from flagship Bitcoin, and provides an overview of leading alternatives making their mark.

The Early Days of Altcoins

Soon after Bitcoin took flight, enthusiastic developers recognizing its genius yet noticing room for improvements began brainstorming variations eventually giving birth to new cryptocurrencies - thus heralding the age of altcoins.

These early alternatives now collectively called altcoins or “alts” all shared Bitcoin’s core premise - operating as digital currencies secured by cryptography and decentralized consensus. However, alts looked to pivot with tweaks across areas like mining algorithms, speed, supply schedule, or privacy features hoping to outpace Bitcoin one way or another.

The very first prominent altcoin called Namecoin which emerged in April 2011 focused on a specialized use case allowing domain name control built into its blockchain. Later more general-purpose alternatives tailored to overcome Bitcoin’s limitations came forth - like Litecoin in 2011 which boosted transaction speeds through faster block times and a different mining algorithm.

What really triggered a flurry of altcoin creation was introduction of Ethereum in July 2015 proposing a radically more versatile blockchain centered on smart contract functionality for executing conditional code and business logic in a trustless manner. Instead of just payments, Ethereum promoted full-fledged computing using its blockchain envisaged to enable decentralized finance, tokens, collectibles, governance, identity and a thriving ecosystem referred today as Web3.

Following Ethereum’s lead came waves of ambitiously conceived yet often half-baked pretenders seen chasing overnight riches during the ICO boom of 2017 - though eventually consolidating down to more promising options as concepts were stress tested when dreams struck reality!

Yet despite endless failures, winners did emerge both through merit and coincidence yielding today’s leading altcoins like Ethereum, Ripple XRP, Cardano, and Solana each spearheading unique niches. They now collectively comprise over half of the total crypto market cap highlighting growing legitimacy of alts as supplement rather than just substitutes.

How Altcoins Differ from Bitcoin

Given Bitcoin’s dominance as original breakthrough and a seemingly insurmountable lead, analyzing pros and cons of alternatives against it makes for an ideal framework to spatially plot the chaotic altcoin universe:

Transaction Speed

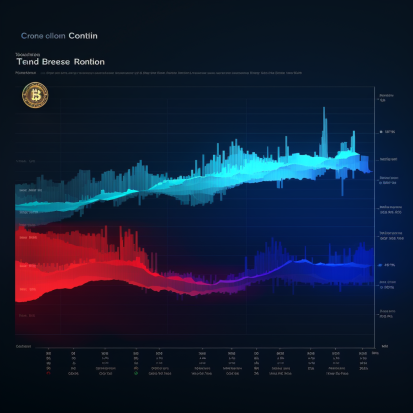

Bitcoin settles blocks on average every 10 minutes with capacity for only ~7 transactions per second constraining scalability for high volume uses. Many alts use alternative consensus models allowing higher throughputs - like Ripple at 1500 TPS, Solana touting 50,000 TPS and Nano delivering sub-second latency. However, tradeoffs exist between transaction speed and trade depth/liquidity which Bitcoin maximizes through more conservative parameterization.

Supply Schedule

Bitcoin has clear absolute scarcity with supply tapering to 21 million as per its ingenious issuance schedule and halving cycles. Promoting ongoing mining incentives requires inflation in altcoins with Ethereum having no cap and others like Dogecoin supporting 5 billion+ supply. On the flipside, aggressive deflationary burning also exists like with Binance Coin. Scarcity models thus vary although Bitcoin is unchallenged on predictability assurances.

Privacy Capabilities

Bitcoin affords pseudonymity whereby one’s real-world identity is not associated with transactions and addresses. However, being an open ledger, advanced privacy remains lacking as analytics firms specialize in transaction graph deanonymization especially for bigger holders. Alternatives like Monero, ZCash and Dash dedicate research into fortifying anonymity. However success is debatable against solutions simply engaging regulated intermediaries for abstraction.

Smart Contract Functionality

Bitcoin’s scripting language intentionally constrains complexity to ensure security and retain sole focus as robust digital money. In contrast, later altcoins prominently Ethereum allow Turing-complete smart contract languages facilitating self-executing conditional code enabling vast DeFi, NFT and Web3 possibilities - arguable extending beyond just payments at cost of higher attack surfaces. Bitcoin however continues evading vulnerabilities through its risk-averse simplicity.

Major Altcoins Making Their Mark

Beyond conceptual variations, ultimately real-world usage and adoption separate promising altcoins from wishful shells. A variety of breakout alternatives have emerged across functions:

Ethereum - Smart Contracts

Ethereum has become the leading smart contract blockchain powering over 3000 decentralized applications and 94 of the top 100 tokens running atop its global computing platform. Through innovations like its Proof-of-Stake consensus and pioneering smart wallets called accounts allowing users to directly control private keys, Ethereum promises to catalyze the Web3 evolution.

Ripple (XRP) - Bank Settlements

The Ripple payment network leverages its XRP token for ultra-fast cross-border settlement aimed at traditional banks and remittance houses. Partners include Bank of America and SBI Remit enabling frictionless fiat conversion flows. Ripple owns over half the XRP supply however sparking centralization concerns despite claims of eventually transitioning to neutral control.

Cardano - Scientific Philosophy

Cardano boasts a research-driven blockchain architected by engineers through peer-reviewed methods prioritizing platform stability. Rivaling Ethereum, Cardano facilitates smart contracts, decentralized apps, token creation and staking solutions via enterprise partnerships in various regions. Long-term plans envision eventual true decentralization after accountability-driven initial phases.

Polkadot - Interoperability

Allowing modular blockchains to seamlessly share data and transactions, Polkadot targets next-generation Web3 needs for interconnectedness and cross-chain composability. Architected by an Ethereum co-founder, Polkadot’s ecosystem links private/consortium chains besides public networks enabling interoperability. The native DOT token engages community governance and provides connectivity resources for building parachains.

Conclusion

Despite Bitcoin’s trailblazing introduction over a decade ago, continuous innovation in the crypto industry has seen unique yet significant alternatives emerge through identifying pain points and imagining aspirational capabilities for decentralized systems and money transcending limitations existent today. For anyone exploring the realm of digital assets, analyzing merits of select altcoins promises to unveil promising opportunities beyond just Bitcoin across second-generation blockchain platforms.